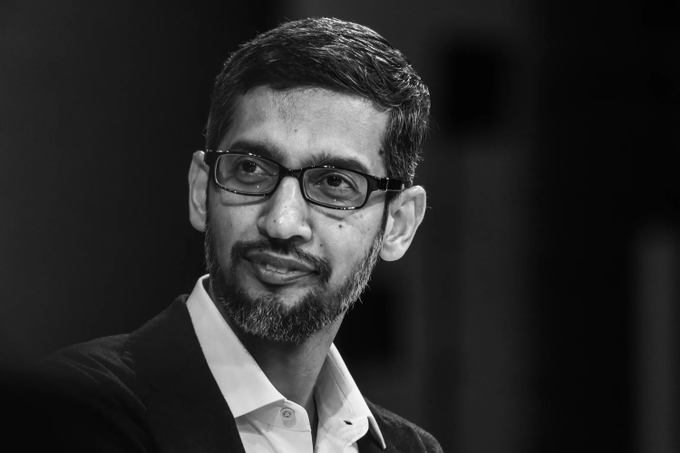

Sundar Pichai, the CEO of Alphabet Inc., Google’s parent company, recently divested approximately $5.15 million worth of company stock. As reported in a filing with the U.S. Securities and Exchange Commission on April 2, 2025, the sale included Class C Capital Stock executed at prices ranging from $157.23 to $159.97 per share. This comes at a time when Alphabet’s stock is nearing its 52-week low of $147.22, reflecting a nearly 20% drop in 2025 amid broader tech industry challenges.

Sundar Pichai, the CEO of Alphabet Inc., Google’s parent company, recently divested approximately $5.15 million worth of company stock. As reported in a filing with the U.S. Securities and Exchange Commission on April 2, 2025, the sale included Class C Capital Stock executed at prices ranging from $157.23 to $159.97 per share. This comes at a time when Alphabet’s stock is nearing its 52-week low of $147.22, reflecting a nearly 20% drop in 2025 amid broader tech industry challenges.

The stock sales were part of a pre-arranged Rule 10b5-1 Trading Plan, created on December 2, 2024, which allows executives to sell shares on a predetermined schedule to prevent insider trading accusations. Despite the transactions, Pichai still holds direct ownership of roughly 2.72 million Alphabet shares. Additionally, he has 227,560 Class A shares and 224,169 Class C Google Stock Units that will convert into Class C stock upon vesting.

This trading plan is scheduled to continue through April 18, 2026. According to Alphabet’s filings in February 2025, both Pichai and the Pichai Family Foundation agreed to sell a total of 876,000 Class C shares under this plan. The first transaction occurred on April 2, and Pichai’s wife, Anjali, also holds 811,275 Class C shares as of the December 2 snapshot.

Despite this year’s lackluster performance, market experts remain optimistic about Alphabet’s outlook. An analysis by InvestingPro rated the company’s financial health as “GREAT,” citing strong fundamentals and resilience in a tough macroeconomic climate. With a staggering market cap of $1.79 trillion, Google continues to dominate key sectors such as search, cloud infrastructure, and AI development.

Wall Street analysts from InvestingPro forecast a bright future for the company, projecting price targets between $167 and $240 per share, suggesting potential growth from its current trading levels. Analysts attribute this positive sentiment to Google’s investments in artificial intelligence and its robust product ecosystem, which continues to position the company well despite increasing competition and regulatory challenges globally.

1 Comment

This was an excellent read. Very thorough and well-researched.