Indian equity markets surged on Tuesday after an extended weekend, with the NSE Nifty 50 Index advancing by 2.4%, surpassing its April 2 closing levels. This bounce back marks India as the first major market worldwide to recover from losses tied to the reciprocal tariffs imposed by former US President Donald Trump earlier this month. While most Asian markets remain down by over 3% since the tariff announcements, India’s resilience highlights its growing status as a relative safe haven amidst global market instability.

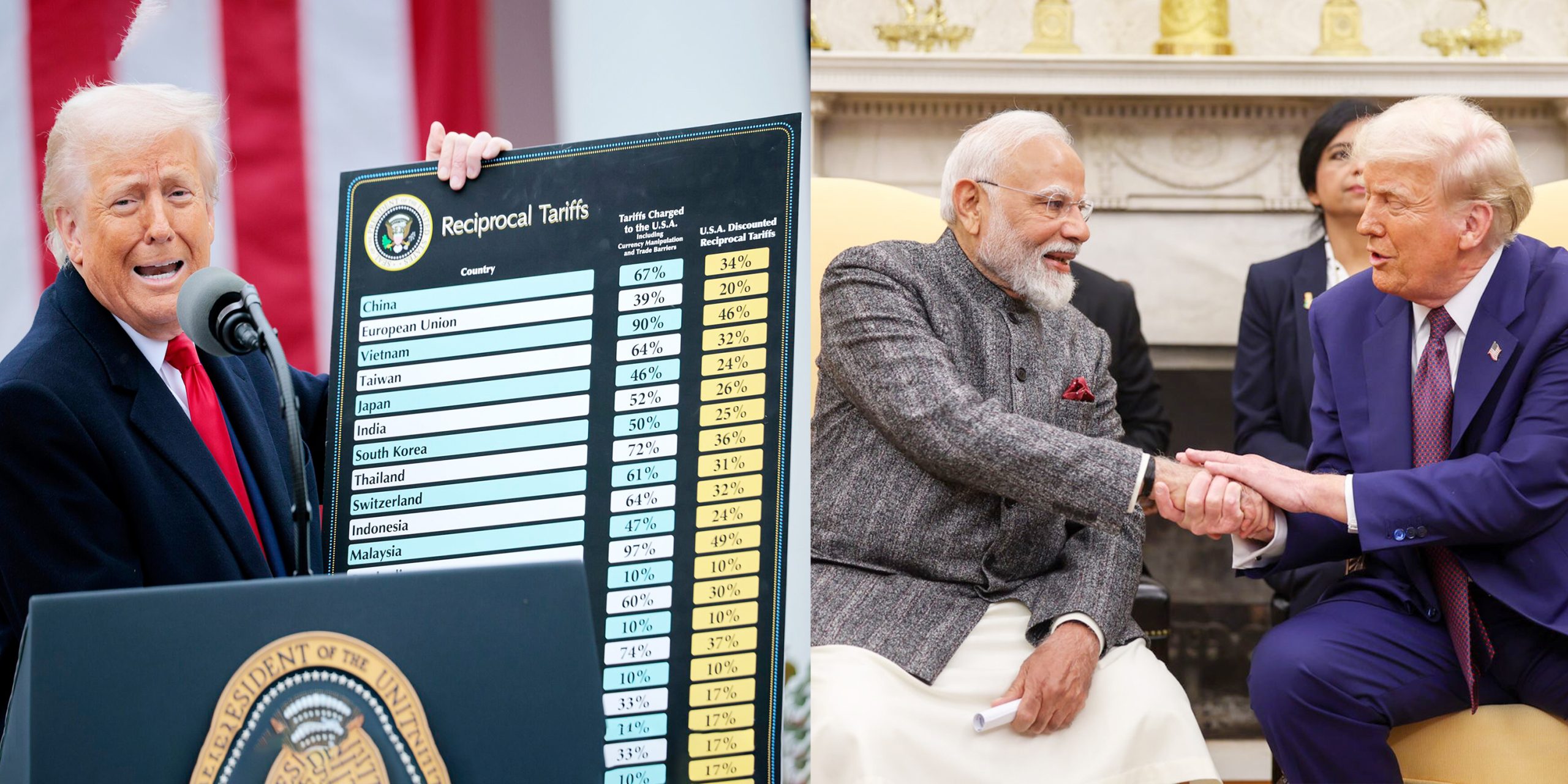

The country’s strong domestic fundamentals continue to appeal to investors, who see India’s economy, largely driven by domestic demand, as better positioned to weather a potential global slowdown compared to other nations more vulnerable to the impact of US tariffs. With the escalating US-China trade conflict, India has positioned itself as an attractive alternative for global manufacturing, maintaining a conciliatory stance and seeking provisional trade agreements with the US, unlike China’s retaliatory approach.

Gary Dugan, CEO of The Global CIO Office, emphasized India’s appeal, noting, “We remain overweight India in our portfolios,” pointing to solid domestic growth and the likely shifting of supply chains away from China. This makes Indian equities an attractive medium-term investment.

India’s swift recovery follows a nearly 10% decline in the Nifty 50 over the past two quarters, largely due to slowing economic growth, high valuations, and foreign investor outflows. This year alone, foreign investors have pulled out over $16 billion from Indian equities, nearing the record $17 billion withdrawn in 2022.

Despite this, investor sentiment is improving, supported by lower stock valuations, expectations of aggressive rate cuts by the Reserve Bank of India, and falling crude oil prices, which are favorable for India’s import-heavy economy. Currently, the Nifty 50 trades at 18.5 times its projected earnings, lower than its five-year average of 19.5 and far below its peak multiple of 21 in late September.

Analysts highlight that India, with its low direct revenue exposure to the US, especially in goods trade, is relatively better positioned amid trade war risks. Rajat Agarwal, strategist at Societe Generale, stated, “India is not insulated, but it is better positioned in the face of trade war risks.” Additionally, if oil prices remain low, Indian equities are expected to benefit. India’s contribution to total US imports was just 2.7% last year, far lower than China’s 14% and Mexico’s 15%, reinforcing India’s position as a trade war safe haven.