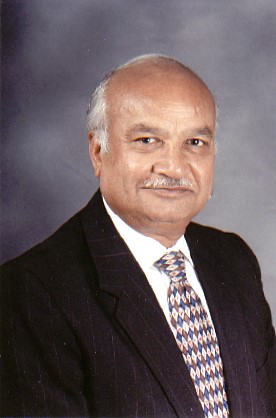

Amit P. Mehta, an esteemed Indian-American judge originally from Patna, India, currently presides over a critical antitrust lawsuit brought forth by the U.S. Justice Department against Google. Appointed to the U.S. District Court for the District of Columbia in 2014, Judge Mehta’s legal expertise and unique background have positioned him as a prominent figure in this significant legal matter.

Amit P. Mehta, an esteemed Indian-American judge originally from Patna, India, currently presides over a critical antitrust lawsuit brought forth by the U.S. Justice Department against Google. Appointed to the U.S. District Court for the District of Columbia in 2014, Judge Mehta’s legal expertise and unique background have positioned him as a prominent figure in this significant legal matter.

This legal dispute initiated when the U.S. government accused Google of engaging in illicit practices aimed at establishing and maintaining a dominant position in the realm of online search and search advertising. The ongoing trial aims to determine whether Google’s actions constitute violations of antitrust laws and whether the company should be held responsible for any anti-competitive behavior.

Judge Mehta’s professional journey began with the completion of his undergraduate studies at Georgetown University in 1993, followed by his legal education at the University of Virginia’s law school in 1997. After law school, Mehta embarked on a diverse legal career that included roles at Latham & Watkins LLP and a clerkship with Judge Susan P. Graber. Later, he joined Zuckerman Spaeder LLP and eventually the District of Columbia Public Defender Service, before returning to Zuckerman Spaeder. During his time at the latter firm, he specialized in areas such as white-collar criminal defense, business disputes, and appellate advocacy, representing a wide range of clients, including Dominique Strauss-Kahn, the former head of the International Monetary Fund, in a civil lawsuit.

Since taking the bench in December 2014, Judge Mehta has made significant contributions to the legal field. One of his noteworthy rulings in 2019 gained national attention when he asserted that lawmakers should have access to the financial records of then-U.S. President Donald Trump, which were subpoenaed. In the early stages of his tenure, Mehta played a pivotal role in a prominent case within the food industry by blocking a $3.5 billion Sysco deal for US Foods due to regulatory opposition, ultimately leading to the cancellation of the merger.