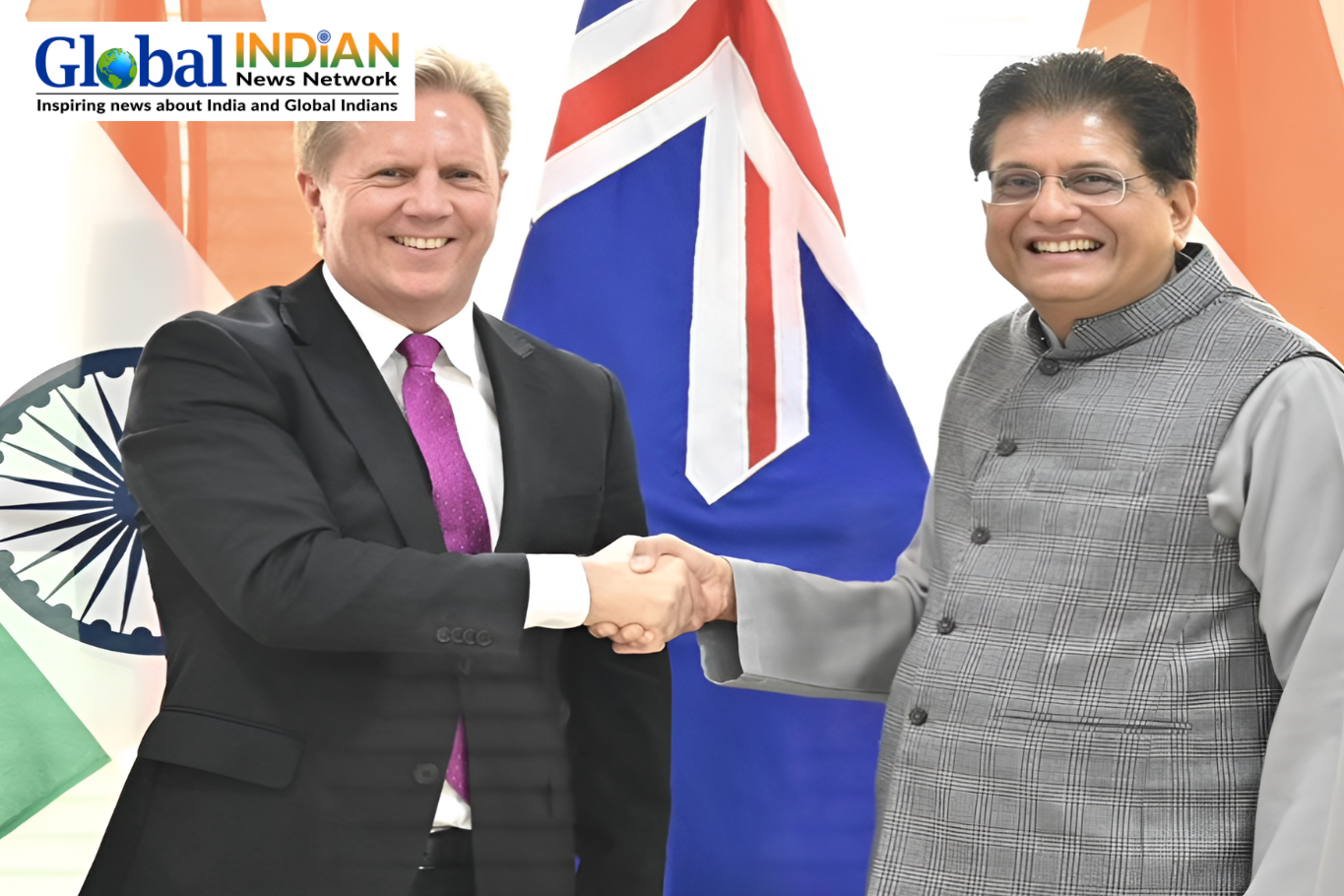

India and New Zealand have concluded negotiations on the Financial Services Annex under the Free Trade Agreement (FTA), marking a significant milestone in strengthening bilateral economic and strategic cooperation, according to a statement issued by the Ministry of Finance on Tuesday.

India and New Zealand have concluded negotiations on the Financial Services Annex under the Free Trade Agreement (FTA), marking a significant milestone in strengthening bilateral economic and strategic cooperation, according to a statement issued by the Ministry of Finance on Tuesday.

The India–New Zealand Financial Services Annex goes beyond standard commitments under the General Agreement on Trade in Services (GATS) and comprises 18 comprehensive articles. The agreement strengthens cooperation in financial services through forward-looking provisions covering digital payments, fintech, data transfers, back-office services and regulatory collaboration.

The pact is expected to position India as a fintech hub while expanding its financial services footprint in New Zealand and facilitating the entry of New Zealand financial institutions into India’s rapidly growing market.

At present, only two Indian banks — Bank of Baroda and Bank of India — operate subsidiaries in New Zealand with a total of four branches, while New Zealand has no banking or insurance presence in India. The agreement is expected to act as a catalyst for deeper financial integration between the two countries.

Under the Financial Services Annex, both nations have committed to developing interoperability between domestic payment systems and supporting real-time cross-border remittances and merchant payments through integrated Fast Payment Systems. This provision strengthens India’s digital payments ecosystem, enhances remittance flows from the Indian diaspora and creates new opportunities for Indian payment service providers, leveraging platforms such as UPI and NPCI.

The agreement also promotes collaboration in financial services innovation, including knowledge-sharing through Regulatory Sandbox and Digital Sandbox frameworks. These provisions support cross-border fintech applications, regulatory learning and innovation partnerships, while reinforcing India’s sandbox initiatives.

India and New Zealand have reaffirmed each other’s right to maintain regulatory and legislative frameworks governing financial data transfer, processing and storage, ensuring data sovereignty and consumer privacy protections while enabling cross-border digital operations.

The pact also safeguards Indian financial institutions from arbitrary or discriminatory credit assessment practices in New Zealand, ensuring national treatment and improved market access for Indian banks, insurance firms and financial service providers.

Additionally, both countries have committed to supporting back-office and financial services support functions, leveraging India’s global leadership in information technology and business process services. This is expected to drive cost-efficient service delivery and support growth in India’s financial services, IT and outsourcing sectors.

The agreement includes progressive commitments on market access and national treatment in key banking and insurance sectors. India’s offers include enhanced foreign direct investment limits and a liberalised bank branch licensing framework, allowing up to 15 foreign bank branches over a four-year period, compared to 12 under previous GATS commitments.

Officials said the agreement will strengthen India’s position in global financial services exports while enabling New Zealand’s financial institutions to participate more competitively in India’s dynamic and expanding financial services market.