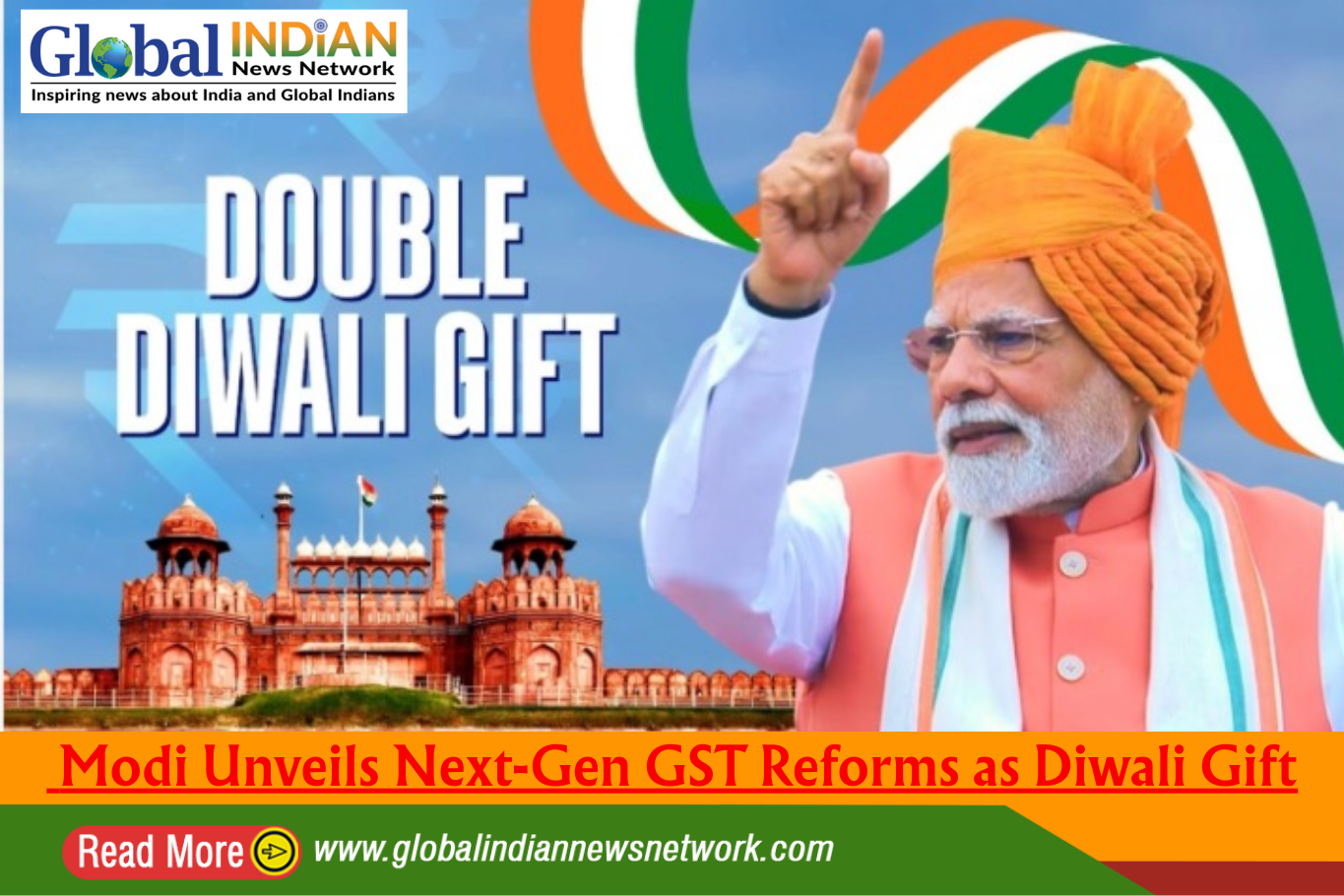

On India’s 79th Independence Day, Prime Minister Narendra Modi used his historic Red Fort address to set forth an ambitious plan for economic reform, promising citizens a “Double Diwali” this year through sweeping next-generation GST changes.

On India’s 79th Independence Day, Prime Minister Narendra Modi used his historic Red Fort address to set forth an ambitious plan for economic reform, promising citizens a “Double Diwali” this year through sweeping next-generation GST changes.

In his 103-minute speech — the longest Independence Day address by any Indian prime minister — Modi called for a stronger, self-reliant India, urging the nation to commit to building the “samarth Bharat” envisioned by freedom fighters. He pointed to recent income tax simplifications and announced that the government’s next major step will be overhauling the Goods and Services Tax (GST) system to make it fairer, simpler, and more beneficial to all citizens.

“This Diwali, I will give the nation a great gift,” Modi declared. “After eight years of GST reform, it’s time to review, consult with states, and bring next-generation GST reform.”

The reform plan targets three key areas: structural changes, rate rationalization, and ease of living measures.

Structural reforms will tackle inverted duty structures, resolve classification disputes, and stabilize tax rates and policies. These measures aim to cut down on legal disputes, make compliance easier, and strengthen domestic industries.

Rate rationalization will lower taxes on everyday essentials and aspirational goods, making them more affordable. The government is considering reducing the number of tax slabs to two main categories, with only a few items subject to special rates. The removal of the compensation cess provides greater flexibility for adjusting rates within GST.

Ease of living measures will simplify registration, return filing, and refund processing. Features like pre-filled returns and automated refunds for exporters will minimize paperwork, giving small businesses, MSMEs, and startups more time to focus on growth.

The proposals have been sent to the Group of Ministers (GoM) under the GST Council for review. The central government will work with states to build consensus, aiming for swift GST Council approval so that benefits can reach businesses and consumers within the current fiscal year.

If implemented as planned, the reforms could significantly reduce costs, energize small enterprises, and create a more business-friendly tax environment — making Modi’s promised “Double Diwali” not just symbolic, but economically tangible.