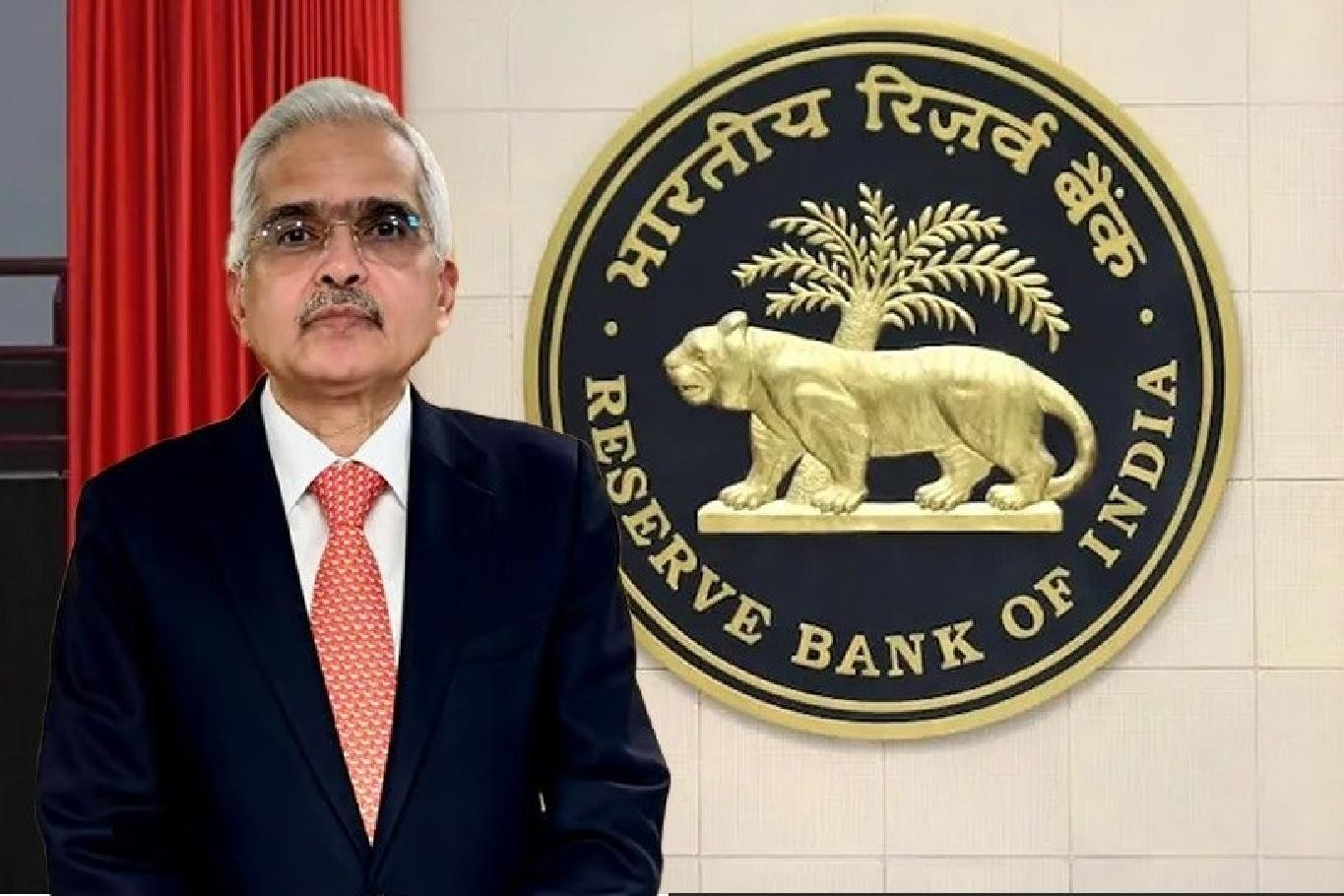

RBI Governor Shaktikanta Das highlighted a significant uptick in rural demand within the Indian economy, driven by growth in private consumption and investment as reflected in the latest GDP figures.

Addressing the FIBAC 2024 conference in Mumbai, Das pointed out that recent data from FMCG companies indicates a revival in rural demand. He noted that private consumption, making up around 56 percent of total demand, has seen a significant growth rate of 7.4 percent. This represents a substantial rebound from a mere 4 percent growth in the latter half of the previous year, reinforcing the recovery of rural demand.”

Das also discussed the 6.7 percent GDP growth in the first quarter, stating, “The data demonstrates that the core drivers of India’s economic growth are gaining momentum rather than diminishing.” He expressed confidence that this positive momentum assures the continued strength of India’s growth narrative.

In addition to private consumption, Das emphasised the significance of investment, which represents 35 percent of GDP and has also grown by 7.5 percent, aligning with the recent economic momentum. He noted that over 90 percent of GDP growth has met expectations, with private consumption and investment contributing positively. The slowdown to 6.7 percent in GDP is attributed to reduced government spending due to elections and the Model Code of Conduct.

Das highlighted that more than 90 percent of GDP growth remained robust and above 7 percent, suggesting that the observed slowdown should not be dismissed lightly. He also provided insights from RBI data showing that bank credit to agriculture and related sectors grew by 18.1 percent year-over-year, and credit to industries increased by 10.2 percent in July compared to the previous year, with MSMEs seeing a 14.4 percent growth.

Encouraging private sector investment, Das mentioned that with the monsoon progressing well and strong kharif sowing, food inflation is expected to improve. However, he cautioned that vigilance is required to monitor inflationary pressures.

He concluded by noting that the balance between inflation and growth is favourable, and emphasised that maintaining price stability through monetary policy is crucial for sustained economic growth. Das praised the financial sector’s robust health and underscored India’s potential for significant advancements, driven by a dynamic population, a resilient economy, and a rich tradition of entrepreneurship and innovation.