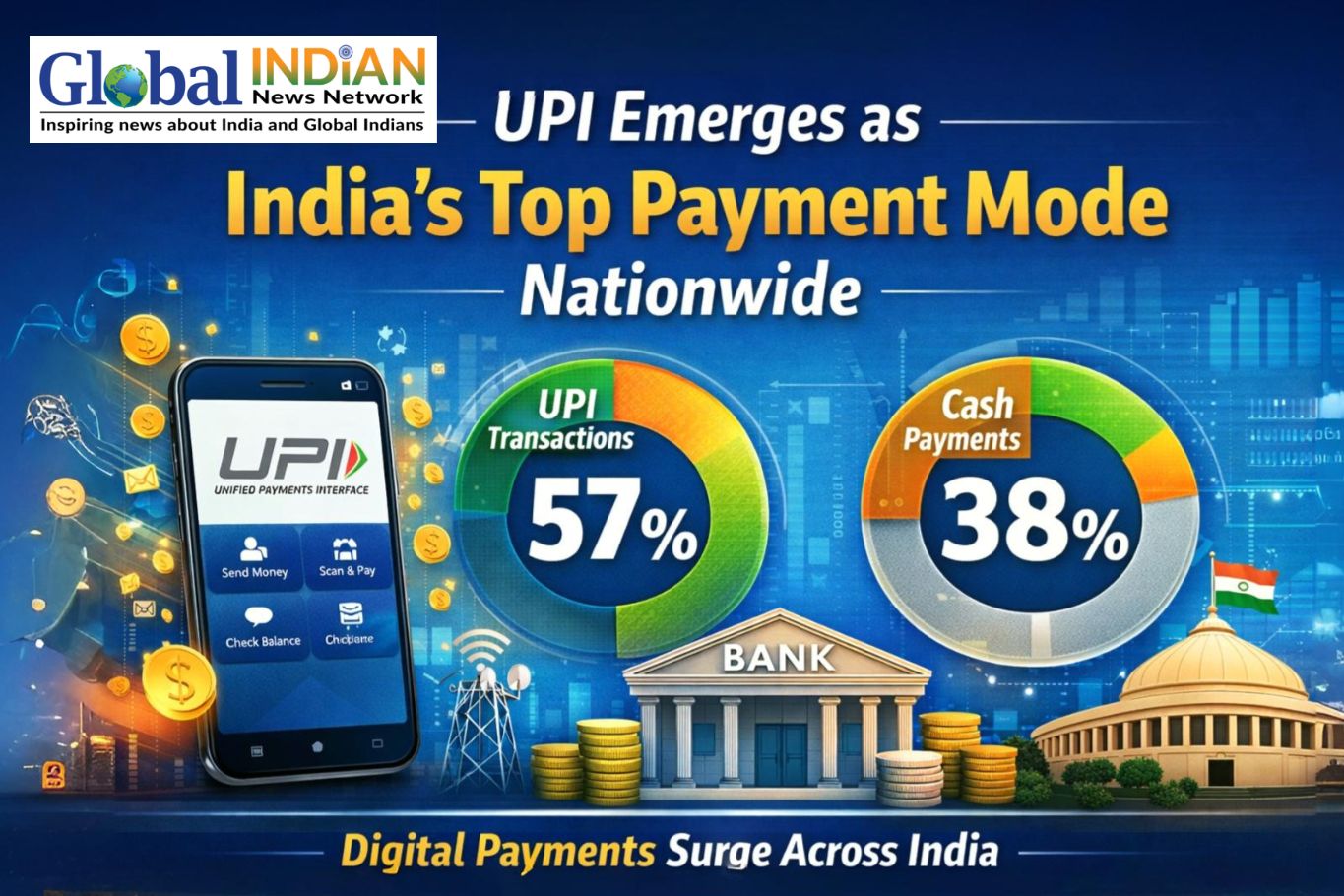

India’s digital payment ecosystem has achieved a major milestone, with the Unified Payments Interface (UPI) emerging as the most preferred method of transactions at 57%, overtaking cash usage, which stands at 38%, according to a recent survey published by DD News. The findings highlight a rapid transformation in consumer payment behaviour, with digital transactions becoming increasingly prevalent across both urban and rural areas.

India’s digital payment ecosystem has achieved a major milestone, with the Unified Payments Interface (UPI) emerging as the most preferred method of transactions at 57%, overtaking cash usage, which stands at 38%, according to a recent survey published by DD News. The findings highlight a rapid transformation in consumer payment behaviour, with digital transactions becoming increasingly prevalent across both urban and rural areas.

The surge in UPI adoption has been driven by widespread mobile phone penetration, improved internet accessibility, and growing acceptance of digital banking products. UPI’s ease of use, speed, and compatibility with multiple platforms have made it a popular choice for both businesses and consumers, reflecting a shift in how financial transactions are conducted daily.

The survey also underscores the role of government initiatives in promoting financial inclusion. Modern infrastructure and supportive policies have accelerated the adoption of digital payments, enabling small businesses, merchants, and the general public to participate more actively in the formal financial system. This shift has improved transaction transparency, efficiency, and accessibility, supporting broader economic growth.

Experts suggest that UPI’s increasing dominance will bolster e-commerce, simplify business operations, and strengthen India’s overall digital economy. The continued innovation in fintech, combined with robust security measures and strong user trust, is expected to drive further adoption of digital payment systems in the coming years.

India’s leadership in real-time payment systems positions the country as a global benchmark in digital financial technologies. The survey results reinforce India’s reputation as a pioneer in developing efficient, secure, and widely accepted digital payment platforms, signalling a future where cashless transactions play an even larger role in the nation’s economic activity.